When is the next crypto bull run and how are you going to make money out of it.

Let’s take a look at history and see just what it can tell us

Placing your bets early

First of all, we are not gamblers here we want to be sophisticated investors relying on figures and not fear.

I have said all along to stay in the top 50 coins and in particular with Bitcoin, Etherium, and Solano as the favorites.

Saying that World Coin looks at a potential bear run for the next year. The attached chart is not as pretty as I would like and they base this on history repeating itself.

However, in any Bear market, there are sometimes shooting stars so we need to find a few of them.

Raul Paul is expecting Etherium to rise to $10,000 by the end of 21 but is that still possible in a Bear market.

Michael Saylor has all his money on a $ 100,000-bit coin by the same time.

Invest Answers still backs Solano to be the cream at the top so who will be right.

When the market takes a hit

As investors, we are looking at long-term results and not day trading sugar hits so we understand that there will be highs and lows along the way.

However, sometimes it pays to take some money off the table even in a Bull run. And vice versa use that to buy into the low periods.

One theory is that most good coins won’t go below the historic low point so you can set a buy target in that

cycle.

Panic is not an option in this market.

Remember that year-on-year growth of at least 100% is inevitable.

A great time to invest

There is little doubt that buying the dips can create an opportunity going forward.

However, riding the dips without panic can also be a great investment decision.

The things that make a difference

What causes the Bulls and Bears to come and play.

There are lots of reasons for this however the first is market sentiment.

This applies to Whales, Dolphins, Banks, investment groups, and us minnows.

First of all, any adverse situations may trigger an avalanche of sales. High on the list is Wars.

However, even a sell-off by someone in the news can create a follow-me action. I refer here to Elon Musk

who bad Mouthed Bitcoin because of the perceived overuse of electricity. He changed his mind but created some panic.

The Chinese banned Bitcoin mining however it was widely reported they banned Bitcoin which was False.

The miners re-entered the market stronger and greener.

Covid -19 created an initial panic reaction causing a Market flutter. They all returned

Now inflation in nearly every country is creating market concern and future doubt.

A problem with the economy

Government bonds carry an interest rate of about 2% along with bank deposits and super funds.

With inflation at a long time high as reported below

The inflation rate rose 6.8% in 2021, the highest increase since 1982. The US inflation rate rose 6.8% over the last year, the highest increase since 1982, the Bureau of Labor Statistics reported Friday morning. Inflation rose 0.8% in November after rising 0.9% in October

The Guardian

Therefore you could be falling behind by a big margin in your saving account.

For those living off savings, this is a disaster as they slip behind every month.

Food prices have gone up nearly 30% so a large part of your income is going down the toilet.

All asset classes have problems

First of all Real Estate has seen large value increases. This may be ok for Investors but not the rest of us.

Renters fall further behind and homeowners are trapped in the bubble. It’s great to sell high however you must buy in the same market and the selling costs will be higher.

In Australia, Real Estate went up 21% this year riding on a Federal Reserve 0.1% interest rate. What will happen next? The old saying what goes up must come down applies here

Certainly Gold has its moments however it has been stagnant for the last decade thus creating a losing value for holders.

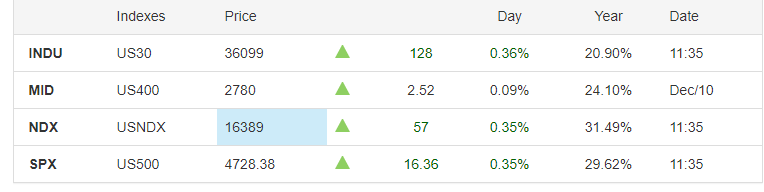

The US stock market has had a reasonable year.

This is providing your portfolio holds the correct shares. If I average these and deduct inflation we have a 19.62% gain.

The crypto market this year

A rise from 193 billion to 2.6 trillion is outstanding growth. Coin market charts.

The big money is moving into the crypto sphere and will continue to grow every year.

Every top coin has seen growth and will surely see much the same next year.

I looked at the best time to buy into the market.

What should yo do in the new year?

None of this is investment advice and all investments have an element of risk. However, when we look at the facts we are all in financial trouble.

The world is on the brink of change. The labor market is broken, a housing crash is just around the corner, Interest rates remain a small percentage of inflation and eroding our earnings. Gold is going nowhere and even the reliable stock market is just holding its own.

It is no wonder the smart money is going into the crypto market.

Caution, not everything is a bed of roses.

The crypto market comprises a few dogs that will take you nowhere and give you nothing.

There are over 9000 different coins all promising to do something with nothing. Therefore you must understand the market as an investment opportunity and not a gambling table.

The top coins are mostly there because they represent value. Like any opportunity do your homework

and make sure you make wise decisions based on facts and not emotion.

The opportunities are endless however the pitfalls are everywhere.

Conclusion

The author has investments in Bitcoin and several Alt-coins plus some leading stock market contenders.

He is not an expert adviser and does not pretend to offer advice.

My sole intent is to help awareness of a change in the structure of document transactions and that a new world is happening. Those that see the future as it rolls out are better placed to take advantage and enjoy the fruits of their investments.

Invest wisely and never Gamble with your savings.